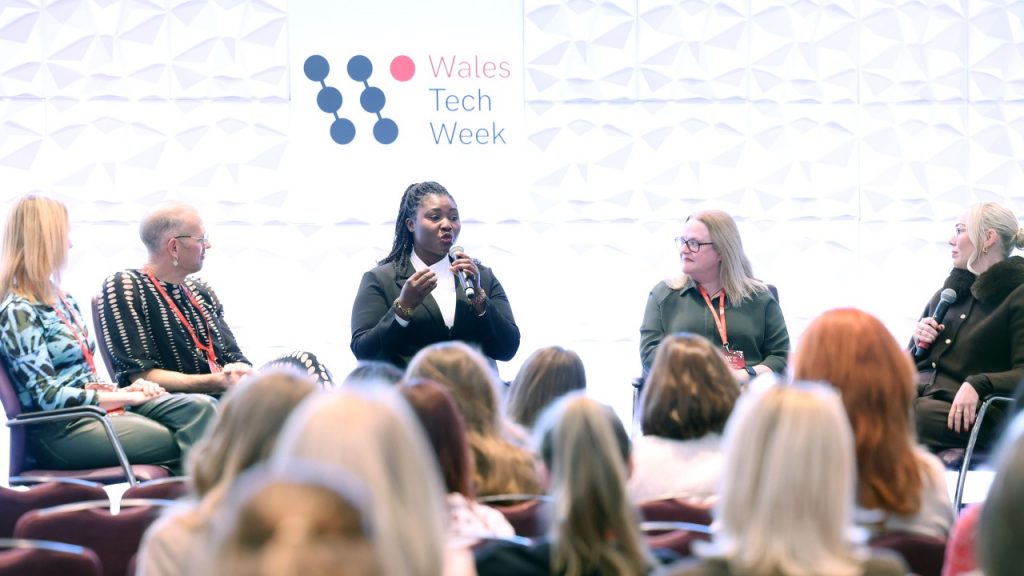

Earlier this week, I attended Wales Tech Week and participated in three insightful sessions that explored generative AI in finance, digital currencies, and the future of the insurance industry. It’s remarkable to see how Wales is rapidly transforming the financial services sector, and how uniquely positioned it is to lead this next chapter. It continues to combine entrepreneurial drive with evidence-based research, cross-sector collaboration, and a culture of innovation.

Across all sessions, one theme kept resurfacing: the pace of change has accelerated beyond anything the industry has experienced before. Generative AI is developing five to ten times faster than the early internet era. Digital assets and stablecoins are moving from the fringes to the heart of global financial infrastructure. And insurance, often (unfairly) labelled as slow-moving, is grappling with new forms of risk, complex data challenges and shifting customer expectations in real time.

Despite this disruption, Wales remains distinctive. Its history, featuring companies from Admiral to GoCompare, Confused.com, and a rising tide of fintech and Insurtech firms, demonstrates what can be achieved when an ecosystem focuses on collaboration rather than competition, and adopts innovation with a uniquely Welsh pragmatic approach. The current developments seem to mark the start of a new significant chapter.

Generative AI: From Chatbots to Agentic Systems

The discussion on generative AI made it clear that we are moving well beyond chatbots. Financial institutions are already deploying internal AI copilots, agentic systems capable of actioning tasks, and early versions of speech-to-speech interaction that will fundamentally change customer engagement. However, the biggest transformation is happening behind the scenes: AI is helping staff navigate vast documentation, analyse sentiment at scale, improve fraud detection, and speed up underwriting and claims processing.

Their shared commitment to enhancing rather than replacing human roles is quite impressive as they use AI to improve customer service rather than diminish it. The most successful models are and will continue to combine human empathy with machine efficiency.

Digital Currency: From Hype to Infrastructure

The digital asset session underscored a major shift: stablecoins and tokenisation are no longer theoretical. They are becoming the rails on which future financial systems will operate. Whether powering autonomous agent payments, enabling fractional ownership of assets, or transforming cross-border settlement, digital currencies are poised to become invisible but essential infrastructure.

Wales, with its agility and policy-friendly environment, has the potential to pilot early implementations, just as it drove consumer insurance innovation two decades ago. But it will require more education, regulatory clarity, and a willingness to experiment at the regional level.

Insurance: An Industry at a Turning Point

The insurance conversation highlighted both the urgency and the opportunity. From climate-driven risk to geopolitical uncertainty and new cyber threats, insurers are being pulled into a more volatile world. Legacy systems and multi-layered workflows make transformation slow, yet insurers are finally moving toward data-driven decision-making, modernised tech stacks, and embedded AI.

The sector’s challenge is to innovate without breaking the trust and regulatory obligations that underpin its social role. The solution lies in targeted innovation, improved data quality, and partnerships that combine domain knowledge with new technologies.

Five Areas Where Academic Research Could Unlock the Next Leap Forward

Across all sessions, the conversations revealed research gaps where academia could make a transformative contribution. These are not abstract questions and they sit at the heart of what industry urgently needs:

1. Human–AI Interaction in High-Trust Financial Environments We need deeper research into how customers build trust with AI-driven systems, how to design speech-to-speech tools that preserve empathy, and how to measure the psychological impact of delegating decisions to agents. This is particularly critical in vulnerable customer contexts.

2. Regulatory-Safe Innovation Models for AI and Digital Assets Current regulation struggles to keep pace. Academics can help develop governance frameworks, risk models and safety testing protocols that allow firms to innovate responsibly while meeting Consumer Duty and financial stability requirements.

3. Data Quality, Bias and Interoperability in Multi-Institution Financial Systems The industry’s biggest bottleneck is data. Research is needed on methods for cleansing, structuring, validating and sharing data across insurers, banks, and blockchain networks without compromising privacy or operational resilience.

4. Tokenised Economies and Real-World Asset Markets Tokenisation is advancing rapidly, yet there is a lack of rigorous research on its macroeconomic impact, liquidity implications, systemic risks, and cross-border legal considerations. Wales and the UK more broadly could lead research in this space.

5. Regional Innovation Ecosystems and Talent Retention Models Wales is a case study in how local ecosystems can drive national impact. Research into talent mobility, regional clustering, remote-first work, and comparative advantage could inform how Wales, as well as similar regions, can become long-term centres of fintech excellence.

A Wales-Led Future

Wales Tech Week showcased the depth of talent and the sense of possibility that Wales has to offer. What came through in every conversation was confidence that Wales can lead in AI-enabled finance, digital asset adoption, and customer-centric insurance innovation.

However, to step into that future, we need industry, government, and academia to work in concert. We need to invest in research, champion our success stories, retain our talent, and create policy and business environments that welcome experimentation rather than fear it.

Wales changed the insurance landscape once. It can play a major role in reshaping the next era of financial services and after this week, it feels like that future is already taking shape.

If you attended Wales Tech Week too, I’d love to hear your reflections. What stood out most to you, and where do you see the biggest opportunities next?