The FinTech North Summit in York brought together innovators, investors, regulators, and academics from across the UK to explore how financial technology continues to evolve and redefine the future of finance. Throughout the day, discussions moved seamlessly between topics of innovation, investment, and inclusion, showing how the northern fintech community continues to strengthen its position within the national and global ecosystem.

The morning began with a welcome from the FinTech North team, who highlighted the remarkable growth of the sector across the North of England. With more than 400 firms now generating over 5 billion pounds annually for the UK economy, the region has become a thriving hub of financial innovation. The message was clear: collaboration is at the heart of progress. FinTech North exists to connect people, break down silos, and create the conditions for meaningful partnerships to thrive. The team also announced new initiatives, including the Albert Opportunity Leadership mentorship scheme, designed to support emerging founders and underrepresented talent, alongside upcoming trade missions to Singapore that will help Northern Fintechs reach new markets.

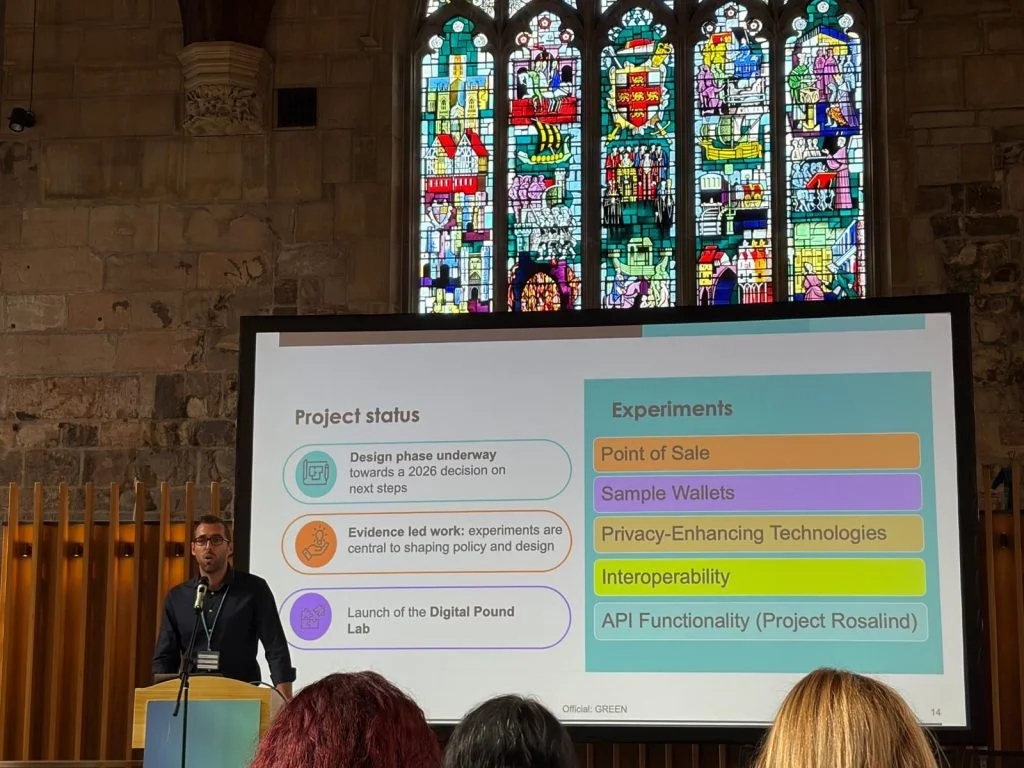

One of the standout sessions came from Danny Russell, Head of Digital Currency Technology at the Bank of England, who presented the work of the Digital Pound Lab. His talk provided an in-depth look at the Bank’s exploration of a potential central bank digital currency. Currently in its design phase, the project aims to co-create and test use cases with industry to understand the technological, commercial, and social implications of a digital pound. More than just a payments system, the Digital Pound is envisioned as a platform for innovation and collaboration between the public and private sectors, with a decision on next steps expected in 2026.

Attention then turned to the flow of investment in fintech. Jositha Ganesan from Innovate Finance presented the organisation’s latest half-year investment report, revealing that global fintech investment reached twenty-four billion dollars in the first half of 2025. While the UK maintained a strong showing, raising around 1.5 billion across 240 deals, the United Arab Emirates temporarily overtook it in the global rankings following Binance’s record two-billion-dollar funding round. The UK remains the clear leader in Europe, but competition from Asia, particularly Singapore and India, is intensifying. Jositha’s message was one of cautious optimism: despite global challenges, UK fintech remains profitable, sustainable, and central to the global conversation. The shift, she noted, has moved away from “growth at all costs” toward sustainable and responsible growth.

Later in the morning, Jordan Dargue, co-founder of Lifted Ventures, delivered one of the most memorable presentations. She spoke passionately about gender-smart investing and the importance of increasing capital flow to female founders. Since launching in 2024, Lifted Ventures has invested eleven million pounds into twenty-six women-led businesses and trained more than fifty angel investors96% of them women. Jordan shared compelling data showing that companies led by women generate twice the revenue per pound invested and achieve higher returns and faster exits, yet only 2% of venture capital currently goes to female-founded teams. Her message was unequivocal: supporting women entrepreneurs is not just the right thing to do, it is smart economics that could add as much as £250 billion to the UK economy.

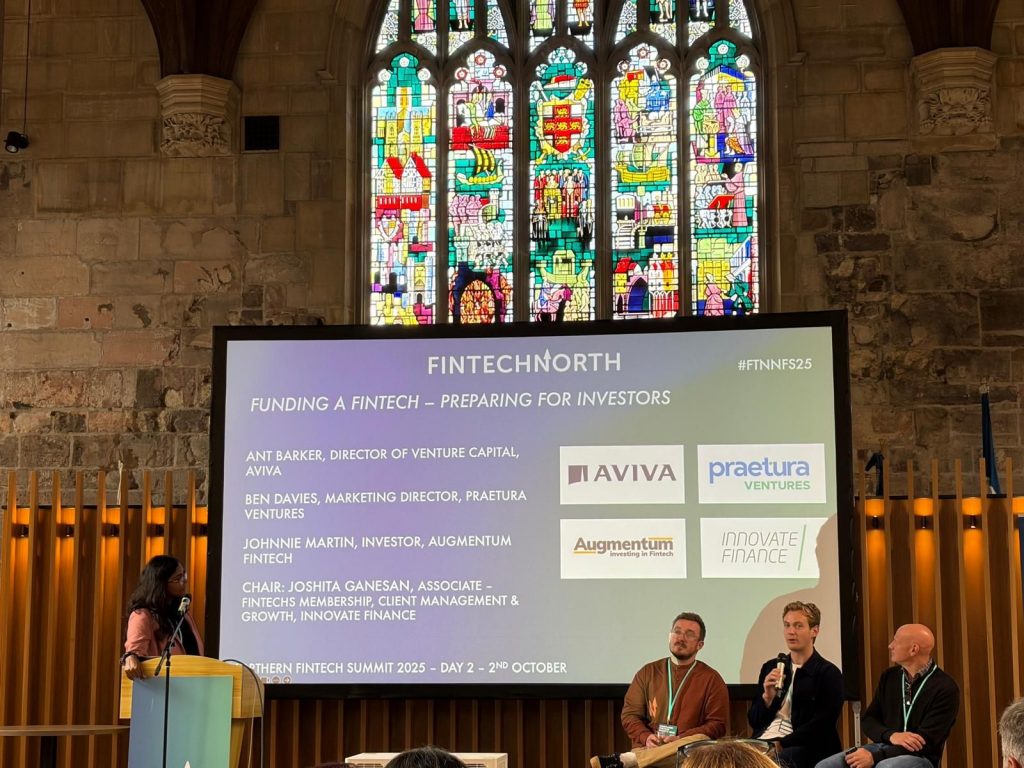

The afternoon continued with a lively investor panel featuring representatives from Aviva Venture Capital, Augmentum Fintech, and Preature Ventures. They offered a candid perspective on what makes a fintech business stand out to investors. The panellists agreed that founders must know their market and their numbers, build strong teams, and treat fundraising like a disciplined sales process. While the environment for raising capital remains challenging, they were united in their belief that there is still plenty of capital available for the best ideas. Businesses that demonstrate scalability, commercial clarity, and sustainable growth continue to attract significant attention.

Another standout came from Bumper, the car-dealership payments platform. By embedding finance directly into the ‘vehicle health check’ flow, drivers can review repairs sent via SMS/email and choose to spread the cost, which increases approval rates for critical work and improves dealer basket sizes. Looking to the future, a presentation from the payments firm Marqeta explored how artificial intelligence and automation are transforming the way people use money. They shared a vision of intelligent, programmable money, where wallets could automatically choose the most cost-effective payment method, manage cash flow, and even embed services like insurance or credit at the point of purchase. Payments, they argued, are becoming not just faster but smarter, moving from simple transactions to systems that actively manage financial decisions for users.

The day concluded with reflections from Colin from the Financial Conduct Authority, who spoke about the regulator’s role in enabling responsible innovation. He emphasised the FCA’s commitment to supporting fintech development through initiatives such as the AI Supercharged Sandbox and new regional innovation sprints, including one scheduled for Leeds later this year. His words captured the spirit of the event: the future of finance can and should be powered from the North, and the region’s fintech community has both the creativity and the ambition to make that happen.

The Summit left a lasting impression of optimism and purpose. It highlighted how fintech investment and innovation are evolving, with new global players rising but the UK is maintaining its strength through research, regulation, and responsible growth. It reaffirmed that collaboration between regions, sectors, and disciplines is the key to progress and that the North continues to lead by example. Among the day’s many insights, the Bank of England’s Digital Pound Lab stood out as a symbol of the UK’s ongoing capacity for innovation, while the UAE’s leap in fintech investment served as a timely reminder that the global race for leadership in this space is far from over. Yet what shone through most clearly was a shared confidence that through cooperation, creativity, and commitment to inclusion, the UK’s fintech ecosystem will remain one of the most dynamic in the world.

What made the day even more special was finishing it off with a lovely chat with Andrew Rabbitt from Incuto. We shared stories and experiences that felt incredibly relatable, reminding me why these events matter beyond the presentations and panels. It was one of those conversations that leaves you feeling inspired and connected, and I left York with a big smile and renewed energy for the work ahead.